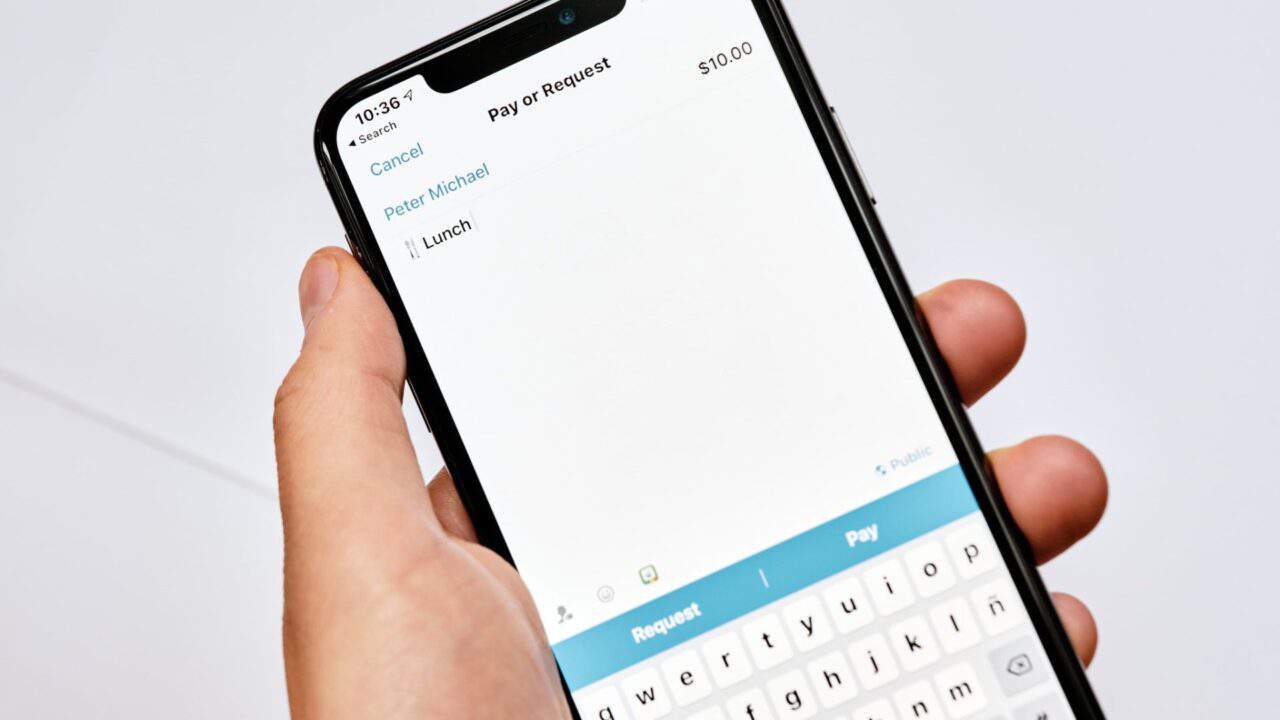

"Venmo" by Focal Foto licensed under CC BY-NC 2.0

"Venmo" by Focal Foto licensed under CC BY-NC 2.0

Republicans on the House Ways and Means Committee passed legislation yesterday repealing the Biden-Harris administration’s policy of a $600 threshold for the IRS to require 1099-K tax forms for Americans using third-party cash transfer apps like Venmo and PayPal.

The Saving Gig Economy Taxpayers Act (H.R. 190), introduced by Rep. Carol Miller (R-W.Va.), would fully restore the original 1099-K reporting requirements of $20,000 and 200 individual transactions. This is the reporting threshold that existed prior to 2021 when Congressional Democrats and the Biden-Harris administration passed the American Rescue Plan Act which reduced the requirements to only $600 and zero requirement for the number of transactions. Vice President Kamala Harris was the tie-breaking vote in the Senate to pass the lower 1099-K threshold.

The bill passed out of committee by a vote of 22-16, with all Republican members present voting in favor of the bill and all Democrats present voting against.

Grover Norquist, President of Americans for Tax Reform issued the following statement in response to the Saving Gig Economy Taxpayers Act’s passage in committee:

“Kamala Harris and Democrats thought they could send the IRS after Americans’ PayPal and Venmo transactions without anyone noticing. People noticed. This bill prevents millions of taxpayers with more than $600 in transactions from third-party vendors from being told by the Biden-Harris IRS that they have a new tax liability this year. Rep. Carol Miller’s bill fully restores the proper 1099-K reporting thresholds for taxpayers and protects them from a politicized IRS that plans to implement this rule once the election is over. Congress should vote to pass the Saving Gig Economy Taxpayers Act and repeal the Biden-Harris 1099-K nightmare.”

Without congressional action, anyone who was paid more than $600 for selling goods or services using a third-party app, such as Venmo or PayPal, will receive a 1099-K tax form starting in January. The Biden-Harris IRS has repeatedly delayed implementation of the $600 reporting threshold until after the presidential election and by doing so undermined efforts to fully restore the original reporting threshold.

The new $600 threshold is the result of a law changed by Democrats in their $1.9 trillion “stimulus” bill passed in 2021 on entirely partisan lines – with every Republican member of Congress voting against the bill. It is estimated that more than 20 million Americans could receive a 1099-K next year if the Biden-Harris policy isn’t repealed.

According to the Joint Committee on Taxation, 90 percent of the tax burden resulting from the lowered 1099-K threshold would fall on filers who make less than $200,000.