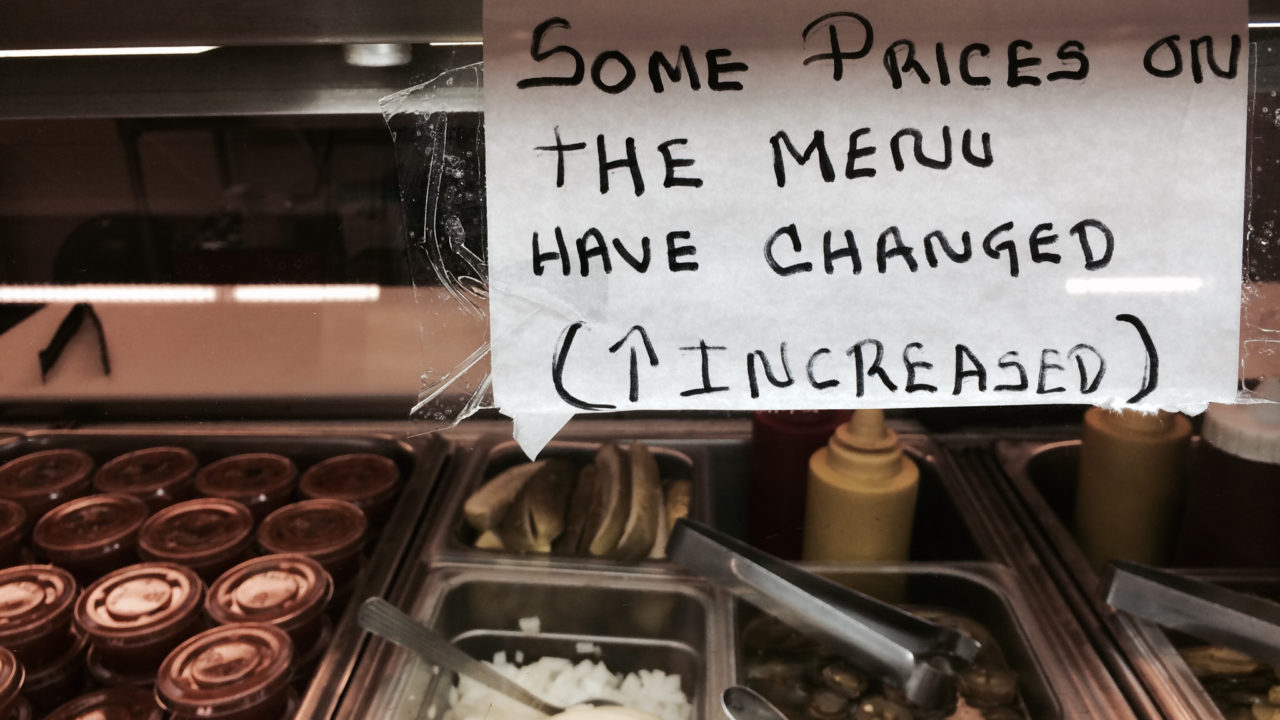

"Inflation" by Atramos is licensed under CC BY 2.0. https://flic.kr/p/pgZttg

"Inflation" by Atramos is licensed under CC BY 2.0. https://flic.kr/p/pgZttg

The consumer price index increased by 7.5 percent on an annualized basis in January, according to the Bureau of Labor Statistics (BLS), its highest reading since February 1982. In January alone, inflation increased by 0.6 percent.

In January 2021, before Joe Biden took over the presidency, annual inflation was at a stable 1.4 percent. Just one year into Biden’s presidency, inflation has increased by more than five times. While inflation has already hit American families hard, Democrats are pushing policies which would make this problem even worse, like trillions in tax increases and wasteful spending.

Since July of 2021, the Biden administration has been insisting this problem would go away. Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen described this inflation as “transitory.” Evidently, those claims have not held up.

Not only does inflation harm consumers by increasing household costs, but it can also have long lasting economic damage. Inflation erodes purchasing power, especially when wages do not keep up.

The erosion of purchasing power is especially concerning given that wages are decreasing. Real average hourly earnings have decreased by 1.7 percent over the past year.

According to BLS, the cost of many goods and services have increased significantly over the past year:

- Energy has increased by 27 percent in the past 12 months.

- Gasoline has increased by 40 percent in the past 12 months.

- Used cars and trucks have increased by 40.5 percent in the past 12 months.

- Beef has increased 16 percent in the past 12 months.

- Bacon has increased 18.1 percent in the past 12 months.

- Furniture and bedding have increased 17 percent in the past 12 months.

- Men’s suits and sport coats have increased 13.6 percent in the past 12 months.

- Women’s dresses have increased 11.1 percent in the past 12 months.

- Utility gas service has increased 23.9 percent in the past 12 months.

- Fresh fish and seafood have increased 12.7 percent in the past 12 months.

The average U.S. household spent $3,500 more in 2021 due to inflation, according to a Penn Wharton University of Pennsylvania Budget Model analysis.

Low-income households were disproportionately harmed, as those households will spend about 7 percent more while higher-income households will spend about 6 percent more. For example, between November 2020 and November 2021, the bottom 20 percent spent $309 more on food, $761 more on energy, $476 more on shelter, $390 on other commodities, and $224 on other services.

Still, the Biden Administration and congressional Democrats wish to move forward with a massive, multi-trillion-dollar spending plan by passing it in “chunks.” This spending would be packed full of handouts to green energy, big labor, and welfare expansion. The idea that this level of wasteful spending is appropriate during a time of such high inflation is careless and short-sighted.

Democrats’ proposal includes massive tax hikes on businesses, like the 15 percent global minimum tax, 15 percent domestic minimum tax, and a new surtax on adjusted gross income (AGI) that will hit pass through businesses. This, similarly, will be passed on to consumers through higher prices. According to a 2020 National Bureau of Economic Research paper, 31 percent of the corporate tax rate is borne by consumers through higher prices of goods and services. By an 81 to 19 margin, voters believe raising taxes on corporations will increase the cost of goods and services, according to a new poll conducted by HarrisX.

The Biden administration and congressional Democrats should focus on growing the economy and helping businesses and working families. Instead, at the expense of Americans’ financial security, they are pushing tax increases and wasteful spending.