Photo by Ehud Neuhaus on Unsplash

Photo by Ehud Neuhaus on Unsplash

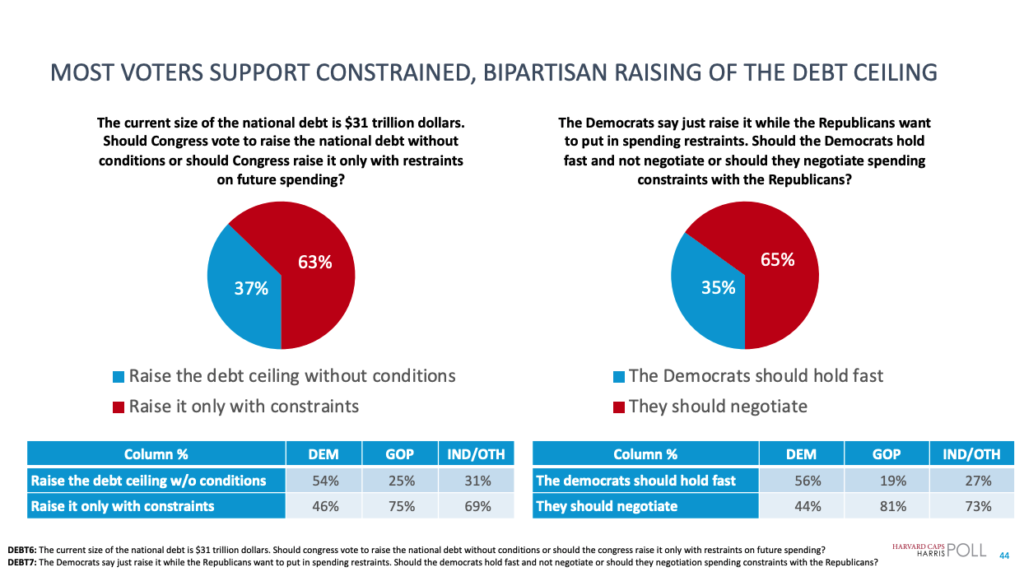

While the Biden Administration and congressional Democrats have insisted that lawmakers should simply raise the debt ceiling without conditions, Republicans believe it should be raised only if it is coupled with restraints on future spending – 63 percent of voters agree.

As outlined in a recent Harvard-Harris poll, nearly two-thirds of Americans want Congress to raise the debt ceiling on the condition that there will be restraints on future spending:

- 63 percent of Americans want Congress to raise the debt ceiling “only with constraints” on future spending, including 46 percent of Democrats.

- 65 percent of Americans say spending limits would help the health of the U.S. government.

- When asked which party should “cave their position to prevent a default,” 52 percent of Democrats said their own party should cave.

- 66 percent of Americans say that Republicans should “hold out for spending constraints.”

Further, Treasury Secretary Janet Yellen’s assertion that the debt ceiling is not something we can “negotiate or bargain about” demonstrates 1) gross entitlement and 2) a lack of knowledge about how debt ceiling fights have been handled historically.

All eight major deficit-reduction laws since 1985 were tied to debt limit legislation. These pieces of legislation have, collectively, reduced spending by trillions of dollars. This includes, most recently, the 1997 Balanced Budget Act (cut $127 billion), the 2009 Statutory Pay-As-You-Go Act, and the 2011 Budget Control Act (cut $2.1 trillion). Without these restraints on spending, it’s hard to imagine how much worse our national debt could be today.

Like they have done in the past, it is imperative that lawmakers take this opportunity to rein in Washington’s out-of-control spending.

In just the last two years, Democrats, without any Republican support, have jammed through over $3 trillion in spending. The Biden Administration also attempted to enact a $1 trillion student loan bailout plan. While the elimination of student loan debt has been halted by courts, changes in income-driven repayment rules – which are still set to be implemented – will account for $450 billion (of the $1 trillion) in additional spending.

In 2022, President Biden and a Democrat-controlled Congress oversaw a massive increase in the national debt of approximately $11,374 per worker. The national debt has now exceeded $31 trillion. The U.S. already holds over $246,000 of debt per taxpayer.

The Congressional Budget Office (CBO) projects that U.S. interest costs will triple within the next decade, accounting for 12 percent of the entire federal budget. Under current policies, the cost of the federal government’s interest expenses could reach $1 trillion a year. In 2021, U.S. interest payments on its debt alone cost roughly $2,600 per household. Eventually, the federal government’s responsibility to pay growing interest costs will leave it incapable of paying for basic government duties.

These past few years, the consequences of the federal government’s out-of-control spending hit Americans where it hurt. Excessive spending led to historic levels of inflation. In 2022, these policies cost the average American family about $7,100 in inflation and higher interest rates, according to a report by the Heritage Foundation.

Conservative lawmakers and advocacy groups have suggested numerous proposals to attach to a debt ceiling hike: Sen. Mike Braun (R-Ind.) and Majority Whip Tom Emmer’s (R-Minn.) Responsible Budget Targets Act (RBTA), freezing debt as a percentage of GDP, establishing bipartisan commissions to reform entitlement programs, capping discretionary spending, returning spending to pre-pandemic levels, banning earmarks, and more.

While it’s clear that restraints on spending must be coupled with a debt ceiling hike, what those restraints should be are to be decided. To start, the Biden Administration will need to come down from its high horse and retract its refusal to negotiate.

The U.S. should not and cannot default on its debt. However, we must not allow lawmakers to, once again, punt their duty to rein in spending.