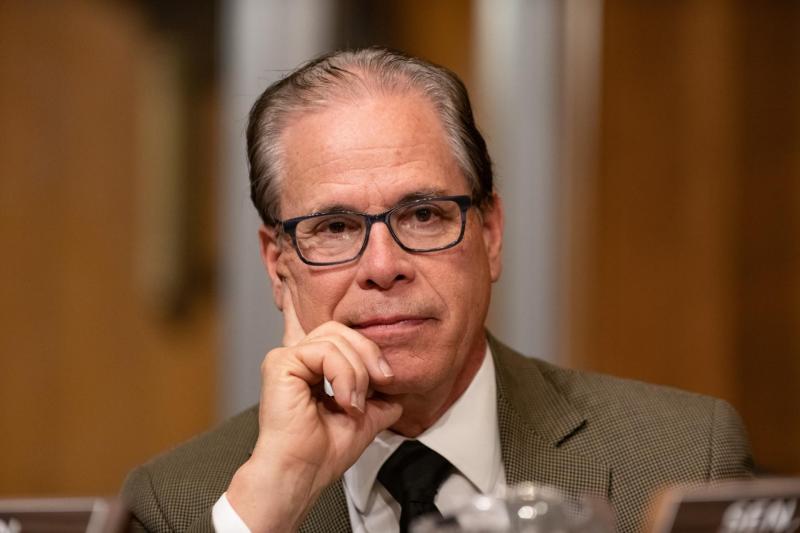

Today, Senator Mike Braun (R-Ind.) and Senate Majority Leader Mitch McConnell (R-Ky.) introduced the Don’t Weaponize the IRS Act, which has garnered the support of 43 Senate Republicans. This bill will codify important protections for non-profit organizations irrespective of their political affiliation and ensure that the IRS has one less tool to harass Americans that are exercising their first amendment rights.

H.R.1 would repeal these protections, providing the Biden administration with ammunition to attack conservative organizations, the same way they were attacked under the Obama administration.

Specifically, this bill would codify the final Rule issued by the Trump administration protecting tax-exempt organizations from unnecessary filing requirements. The Trump Rule ensured that many tax-exempt entities including 501(c)(4)s and 501(c)(6)s do not have to provide the IRS with a list of donors. This list is not used by the IRS for any official purpose. Instead, it creates needless compliance costs on both non-profits and the IRS. Last year, when the Rule was finalized, the Institute for Free Speech estimated that nonprofits would save about $63 million per year compliance costs if Schedule B were fully repealed.

If Democrats repeal this protection, it will create a new way for the IRS to harass organizations based on their political beliefs. Under the Obama administration, there were several cases where agency officials leaked the sensitive information contained on Schedule B forms for political purposes, such as leaking of the schedule B belonging to the National Organization for Marriage.

During this time, the IRS also wrongly used its authority to target and harass taxpayers, especially conservative non-profits. Most notably, the Obama IRS was caught unfairly denying conservative groups non-profit status ahead of the 2012 election.

Lois Lerner’s political beliefs led to tea party and conservative groups receiving disparate and unfair treatment when applying for non-profit status, according to a detailed report compiled by the Senate Finance Committee. Because of Lerner’s bias, only one conservative organization was granted tax exempt status over a period of more than three years.

Since these scandals, the IRS has done little to fix the problem. A 2016 report by the Government Accountability Office warned that the IRS may still be unfairly targeting non-profits “based on an organization’s religious, educational, political, or other views.”

Contrary to opponents’ claims, these protections do not limit transparency. In fact, the same information is still available to the public as before. There are already measures in place to track foreign donations. Even in the unlikely case that the IRS did suspect laws were being broken, it has no authority to share the information it collects with the FCC and the DOJ, the two agencies with the ability to enforce campaign finance laws.

Lawmakers should support Sens. Braun and McConnell’s Don’t Weaponize the IRS Act. The IRS has no official use for this kind of sensitive information. It can only be used for bad.