(Op-ed by Ryan Ellis — IRS Enrolled Agent and President of the Center for a Free Economy — as published in The Washington Examiner)

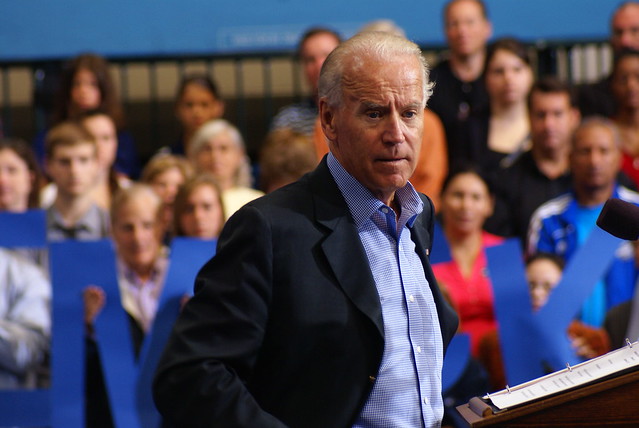

Democratic presidential candidate and former Vice President Joe Biden this week released several years of income tax returns, probably hoping the story would be that he did so and President Trump has not.

However, Richard Rubin from the Wall Street Journal found a much more interesting nugget: in 2017 and 2018, Joe Biden and his wife ran $13 million of profits through two subchapter-S corporations. In so doing, they avoided $500,000 in Social Security and Medicare taxes they would have paid if they instead reported the income as sole proprietors directly on their 1040 income tax returns.

That’s because profits from an “S-corp” are subject to federal income tax, but not to the Social Security and Medicare tax. This is not true for sole proprietors, who are liable for both layers of tax in full.

Biden, incidentally, is campaigning in favor of an across-the-board tax increase.

If this all sounds familiar to veteran politicos, it’s the same tax problem that helped bring down Democrat presidential candidate John Edwards in 2004.

To be clear, the use of S-corps is a perfectly legal tax avoidance strategy deployed commonly in family businesses across the country. It is not tax evasion, but it most certainly is a tax strategy — and if one takes Biden’s history on the matter seriously, it’s a tax strategy he thinks is a loophole.

To be equally clear, Joe Biden is a hypocrite for using S-corporations in this way for at least four reasons. This is, after all, a man who said that paying more in taxes was a “patriotic act.” [Click here to continue reading]